Photo Credit: The Punch

2025-12-27 06:00:00

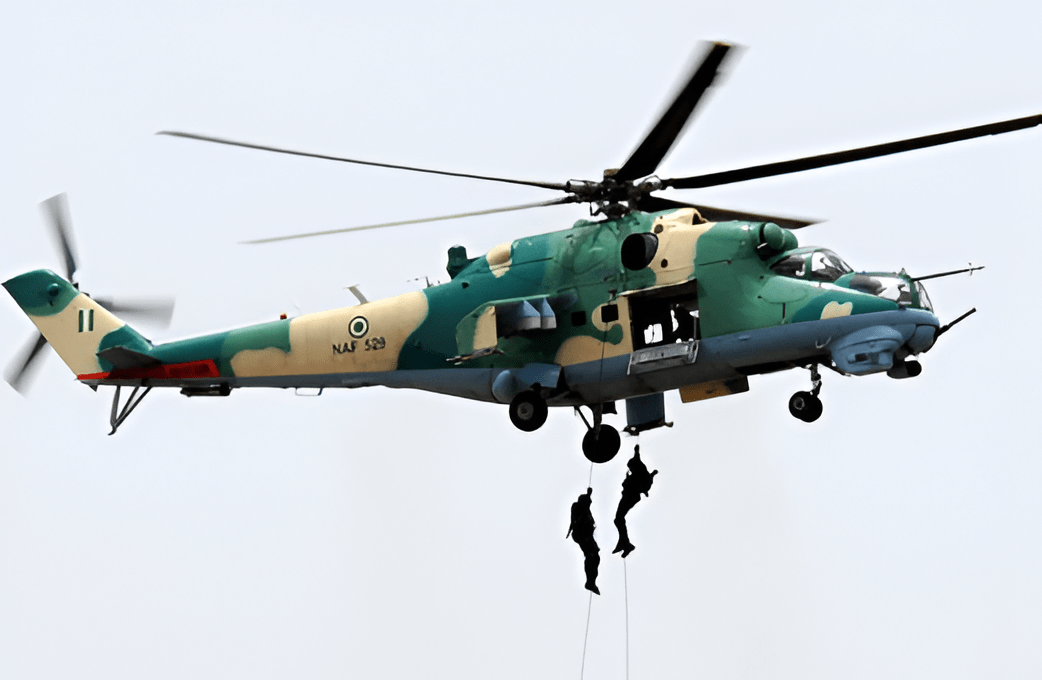

In a statement reported by Vanguard, the Nigerian Army asked the public to ignore a circulating advert claiming the Direct Short Service Course (DSSC) 29 application form for 2026 is available.

The Army said the message is fraudulent and warned Nigerians not to fall victim to scammers who often demand payments, personal data, or bank details under the guise of “recruitment processing.”

Security officials urged citizens to rely only on official Army communication channels for recruitment notices and to report suspicious posts to relevant authorities.

Echotitbits take:

Recruitment scams spike during festive periods and economic stress. A practical next step for readers is to verify announcements on official military platforms before sharing—and to treat any “payment request” as a red flag.

Source: The Punch — December 26, 2025 (https://punchng.com/army-disowns-fake-recruitment-advertisement/)

The Punch December 26, 2025