Oyo approves 13th-month pay and clears some LAUTECH Teaching Hospital arrears.

The Supreme Court has struck out Osun State’s suit seeking release of withheld local government allocations, ruling that the state attorney-general lacked standing to...

The Nigeria Export Processing Zones Authority (NEPZA) has urged the Federal Government to grant a 10-year tax relief for operators within Special Economic Zones,...

Federal revenue from the electronic money transfer levy hit about N360.29 billion between January and October 2025, more than doubling the comparable 2024 figure,...

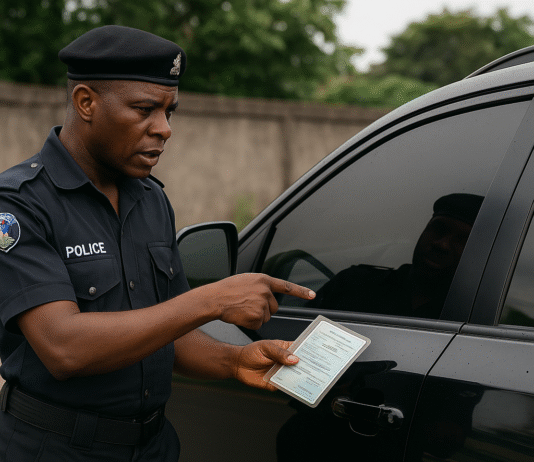

For years, motorists in Nigeria have endured a frustrating ritual: registering their vehicles with the state licensing offices, only to be stopped on the...

The investment market in the country is feeling the effects of aggressive global monetary tightening and rising political and business risks, with capital importation...

Lagos based integrated payments and digital commerce platform, Interswitch has been called out by a customer for incompetency over a failed transaction left unresolved...

Local investors have expressed fear that economic challenge in Nigeria, said to have continued to dampen investment drive and trigger apathy in the Nigerian...

Planned withdrawal of Unstructured Supplementary Service Data (USSD) short code service that enables bank transfer from mobile device, has been suspended by telecommunications operators...

The Senate on Monday passed the 2021 Appropriation Bill of N13.5 trillion.

This followed the adoption of the report of Senate Committee on Appropriations at...