Photo Credit: The Nation

2025-12-27 06:00:00

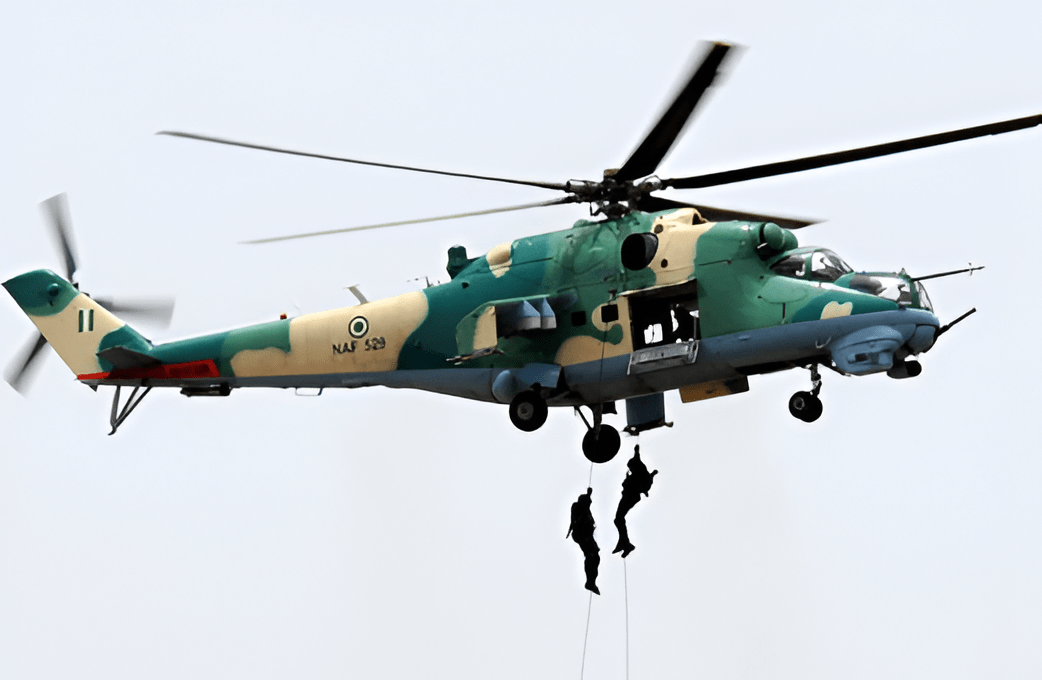

Reporting by The Nation indicates the Nigerian Air Force is intensifying plans to acquire 24 M‑346 fighter ground‑attack aircraft alongside helicopters and additional UAVs to strengthen operational readiness.

The report linked the planned fleet upgrades to persistent security pressures, including banditry and insurgent threats, where faster surveillance-to-strike cycles and better air mobility can be decisive.

Defence watchers say the real test will be sustainment—training pipelines, spares, maintenance contracts, and mission availability rates—so the announced numbers translate into predictable air support in hotspots.

Echotitbits take:

Nigeria’s airpower plan sounds ambitious, but procurement alone doesn’t win campaigns. Track timelines, basing, pilot/crew training, and whether maintenance funding is ring‑fenced. Also watch how UAV integration changes intelligence and civilian‑harm mitigation.

Source: The Nation — December 27, 2025 (https://thenationonlineng.net/naf-to-acquire-24-new-aircraft-uavs-to-boost-operational-readiness/)

The Nation December 27, 2025