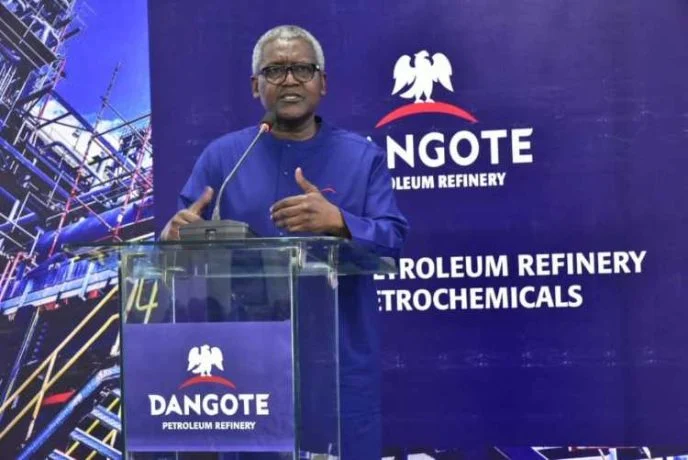

Photo Credit: The Punch

2025-12-25 09:10:00

In a budget-performance update cited by The Punch, Nigeria’s federal government reportedly raised about N6.10 trillion from domestic sources in the first half of 2025 to help plug a wide fiscal gap. The report points to a deficit of roughly N5.70 trillion, with financing largely driven by local borrowing instruments.

The same performance data indicates debt service pressure remains heavy, with large outflows to service obligations even as revenues lag spending needs. That combination—high deficits and high debt service—continues to compress fiscal space for social and capital priorities.

The report also suggests the borrowing mix leaned heavily on bonds and other local issuances, reinforcing the concern that domestic credit may be crowded toward government paper instead of private-sector lending.

Corroborating the same Budget Office picture, another outlet reported the government had to finance the deficit through “domestic borrowing… of N5.70tn” and proceeds including “privatisation… N64.92bn,” while a separate report noted “debt service was N4.44tn,” underscoring the weight of repayments in the fiscal structure.

Echotitbits take: Nigeria’s deficit story is increasingly a debt-service story. Watch for (1) whether revenue reforms lift the non-oil base fast enough, and (2) whether domestic borrowing costs ease—because a sustained high-rate environment makes deficits more expensive and squeezes development spending.

Source: The Punch — December 25, 2025 (https://punchng.com/budget-deficit-fg-raises-n6tn-locally-in-six-months/)

The Punch 2025-12-25