Figures cited by The Guardian show that the Central Bank of Nigeria’s aggressive monetary tightening has successfully reined in inflation but at a heavy cost to business expansion. Lending growth to the private sector has plummeted to its lowest level since 2020, as deposit money banks become increasingly wary of high-risk loans in a high-interest-rate environment. Small and medium-sized enterprises (SMEs) are bearing the brunt of the credit crunch.

Data from the apex bank indicates that credit growth fell sharply to under 1% in the last quarter, a stark contrast to the double-digit growth seen in previous years. While the CBN maintains that high rates are necessary to stabilize the Naira, business groups warn that the lack of affordable credit is forcing many local manufacturers to scale down operations or halt expansion plans entirely.

Vanguard and The Nation also reported on the credit slowdown. Vanguard highlighted that “banks are prioritizing government securities over private loans,” while The Nation quoted a Lagos Chamber of Commerce official who said, “At 30% plus interest, no legitimate business can survive a bank loan in this climate.”

Echotitbits take: The CBN is in a “catch-22” situation—keep rates high to fight inflation and protect the Naira, or lower them to save the real sector. Expect the pressure on the Monetary Policy Committee (MPC) to mount as manufacturers begin to report shrinking margins in their Q1 results.

Source: BusinessDay – https://businessday.ng/business-economy/article/high-interest-rates-push-lending-growth-to-five-year-low/, February 3, 2026

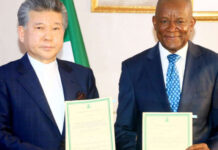

Photo credit: BusinessDay