2026-01-02 09:00:00

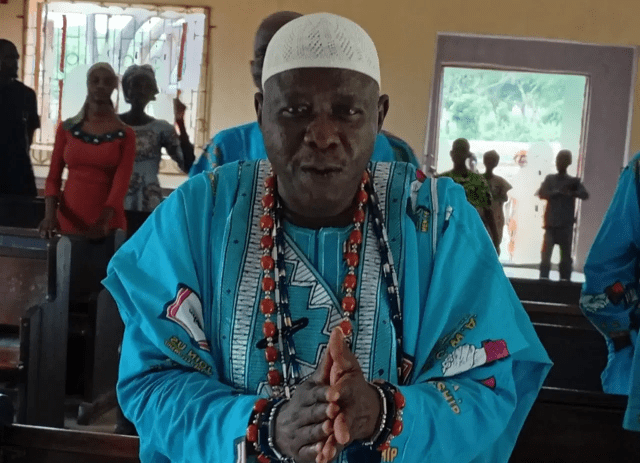

Reporting by Vanguard indicates gunmen attacked a palace in Kwara State and kidnapped a traditional ruler along with his son, who was described as an NYSC member.

Accounts of the incident suggest the attackers targeted the palace directly, overwhelmed limited security presence and escaped with the victims as residents raised alarm.

Security sources say efforts are ongoing to track the kidnappers, as the abduction adds to the pressure on North-Central communities battling recurring kidnapping incidents.

Validation: Punch reported the abduction of the monarch and his son after a “violent” palace attack. Premium Times cited a source describing the assault and reported the monarch’s wife was injured, quoting: “She was hit in the arm by a bullet.”

Echotitbits take: Targeted palace abductions signal confidence and intelligence by criminal networks. Watch for early proof-of-life communications, coordinated search operations, and whether state authorities deploy intelligence-led raids rather than reactive checkpoints.

Source: Vanguard — 2026-01-01 (https://www.vanguardngr.com/2026/01/monarch-son-kidnapped-in-kwara-palace-attack/)

Vanguard 2026-01-01

Photo Credit: Vanguard