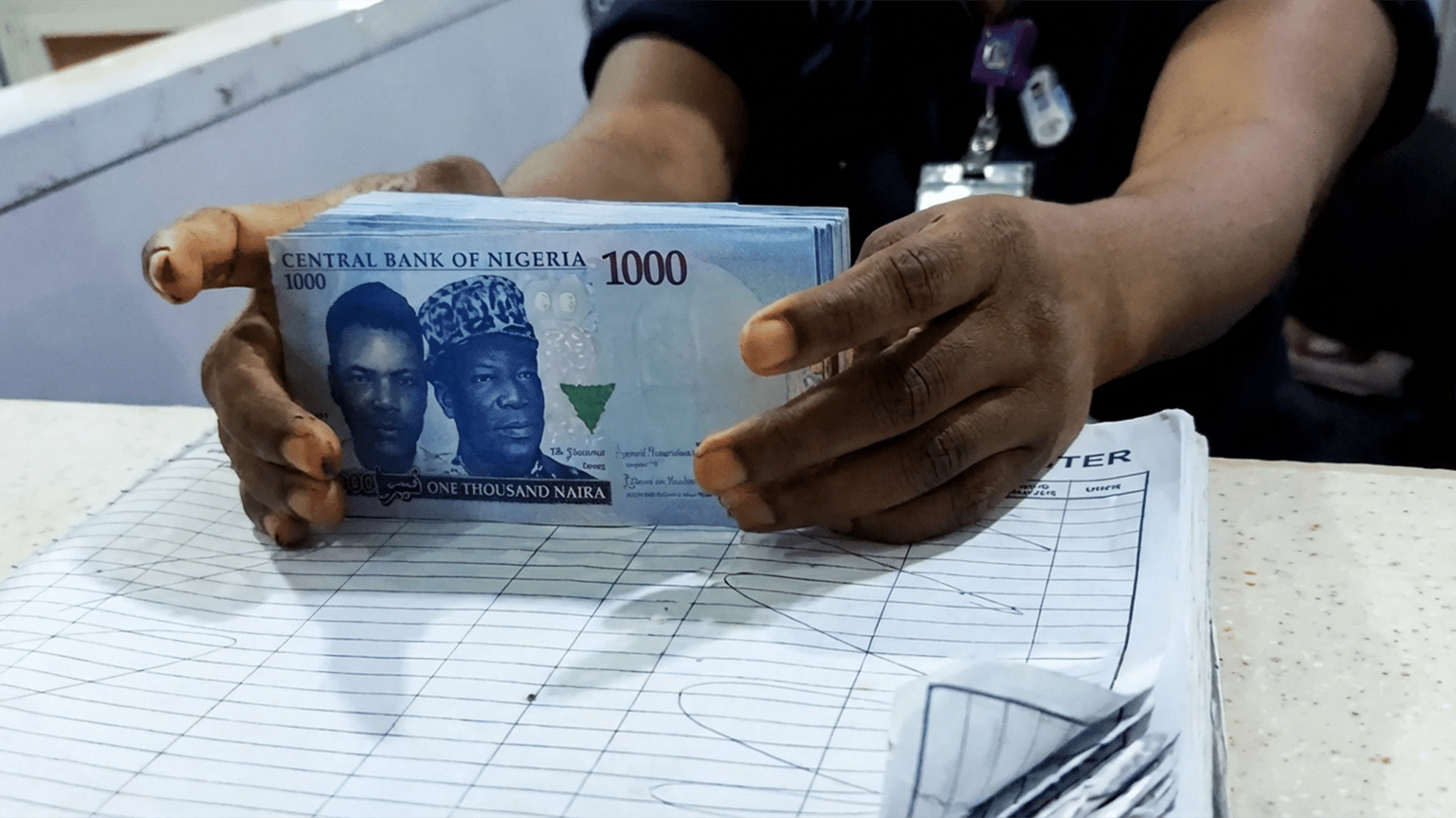

Figures cited by Leadership Newspaper show a significant stabilization in Nigeria’s Foreign Exchange (FX) market, following a high-profile meeting between President Bola Tinubu and the Chairman of Heirs Holdings, Tony Elumelu. Elumelu informed reporters at the State House that the era of acute dollar scarcity is largely over, attributing the progress to recent central bank reforms and improved investor confidence.

During the briefing, Elumelu praised the government’s efforts in harmonizing the FX windows and ensuring a more transparent liquidity flow. He noted that the private sector is beginning to feel the positive impact of these fiscal policies, which has allowed for better planning and increased foreign direct investment into critical sectors like power and manufacturing.

Reports from The Nation and Vanguard corroborate Elumelu’s optimistic outlook. The Nation mentioned that “the Naira has maintained a steady range against the dollar for the third consecutive week,” and Vanguard quoted Elumelu saying: “The FX market is sorted; what we see now is the result of painstaking reforms that have finally gained traction.”

Echotitbits take: While the declaration of the “end” of dollar scarcity is bold, the stability Elumelu references is essential for business planning in 2026. However, the true test remains the sustained availability of FX for small and medium-sized enterprises (SMEs) who often lack the access of larger conglomerates.

Source: The Punch – https://punchng.com/elumelu-meets-tinubu-says-dollar-scarcity-over-fx-market-sorted/, February 14, 2026

Photo credit: The Punch

Tag: Banking News

-

Tony Elumelu Meets President Tinubu, Declares End to Dollar Scarcity

-

Local Currency Firms Up Against Dollar in Early 2026 Trading

Local Currency Firms Up Against Dollar in Early 2026 Trading

Figures cited by Vanguard show that the Nigerian Naira began the third week of January on a strong note, appreciating to approximately 1,418 per dollar in the official market. The move has been attributed to increased liquidity in the Nigerian Foreign Exchange Market (NFEM) and a drop in speculative demand. Analysts say the Central Bank’s efforts to clear outstanding obligations have restored some confidence among corporate buyers.

In the parallel market, the currency also showed resilience, trading between 1,470 and 1,485 per dollar. Market watchers point out that the gap between official and street rates is narrowing—an objective of current monetary policy. Bureau De Change operators say typical New Year volatility has been tempered by a steady flow of diaspora remittances and improved oversight.

The Guardian also reported that rate convergence is a positive signal for international investors. ThisDay quoted a financial analyst saying that improved transparency is contributing to market stability. The market remains optimistic that the Naira can hold its trajectory through the first quarter.

Echotitbits take: Stability is the keyword. While 1,400+ remains a high level, reduced daily swings help businesses plan. The true stress-test will be sustaining liquidity without undue pressure on external reserves.

Source: Reuters — https://www.reuters.com/world/africa/south-african-rand-firmer-ahead-local-inflation-data-2026-01-21/ (2026-01-23)

Photo Credit: Reuters 2026-01-23

-

Naira Maintains Stability as CBN Projects Positive 2026 Outlook

Naira Maintains Stability as CBN Projects Positive 2026 Outlook

The naira traded within a narrow band mid-week as CBN interventions and a more optimistic 2026 forecast supported FX market stability.

Further reporting across multiple outlets indicates the development is drawing heightened attention, with stakeholders watching for next steps from relevant authorities and institutions.

Echotitbits take: Stability is the goal, but the true test will be the CBN’s ability to maintain these levels without burning through foreign reserves. Keep an eye on the February inflation data to see if the currency stability translates to lower consumer prices.

Source: The Guardian — https://guardian.ng/business-services/cbn-survey-projects-steady-naira-improved-economic-activities-in-2026/ (2026-01-21)

Photo credit: The Guardian

2026-01-21 15:00:00

-

SEC Imposes Massive Capital Hike for Fintechs and Stockbrokers

Photo credit: Скачко Виталий / Unsplash (Unsplash License)

2026-01-17 07:00:00

The Securities and Exchange Commission (SEC) has announced a sweeping upward revision of minimum capital requirements for capital market operators. Under the new guidelines, broker-dealers must increase their minimum capital from N300 million to N2 billion, portfolio managers from N150 million to N5 billion, and issuing houses from N200 million to N7 billion.

Reports indicate a June 2027 deadline for compliance, positioning the move as a market-stability and resilience push intended to ensure only adequately capitalized institutions manage investor funds.

Echotitbits take: This is a consolidation trigger for the Nigerian fintech and brokerage ecosystem. Expect accelerated M&A, tighter governance expectations, and near-term operational strain for smaller operators as the compliance window narrows.

Source: The Punch – https://punchng.com/sec-capital-hike-to-spur-mergers-squeeze-smaller-operators/ (January 17, 2026)

Photo Credit: The Punch

-

Parallel Market Pressure Deepens as Naira Slides to ₦1,490 per Dollar

According to Vanguard, the naira came under fresh pressure in the parallel market on Thursday, weakening to about ₦1,490/$—down from roughly ₦1,470/$ earlier in the week.

Figures from the Nigerian Foreign Exchange Market (NFEM) also showed a mild softening in the official close, moving from about ₦1,416/$ to ₦1,421/$, widening the spread between official and street rates.

Market watchers linked the renewed volatility to seasonal FX demand and speculative positioning, even as the central bank has continued to signal optimism around reserve buildup and longer-term convergence.

**Echotitbits take:** The persistent gap between official and parallel rates remains a key credibility test for FX reforms. If liquidity at the retail end stays tight, expect more pressure on prices and confidence—watch closely for the CBN’s next market-facing intervention.

Source: Guardian — https://guardian.ng/business-services/naira-eyes-n1300-at-parallel-market-as-speculators-offload-fx/ 2026-01-08Photo Credit: Guardian