Photo Credit: The Punch

2025-12-28 09:00:00

According to Sunday PUNCH, many state governments are entering 2026 with big spending plans but still lean heavily on federal allocations, loans and other non‑recurring inflows to balance their books.

The report points to weak internally generated revenue (IGR) in several states and warns that capital projects may be squeezed first when revenue assumptions fall short.

Analysts quoted in the report argue that over‑reliance on volatile transfers and debt can discourage local revenue innovation and exposes budgets to national shocks such as oil price swings.

TheCable’s newspaper review also noted that “state governments are banking on federal allocations and loans to fund their 2026 budgets,” reinforcing the recurring pattern across multiple state appropriation proposals.

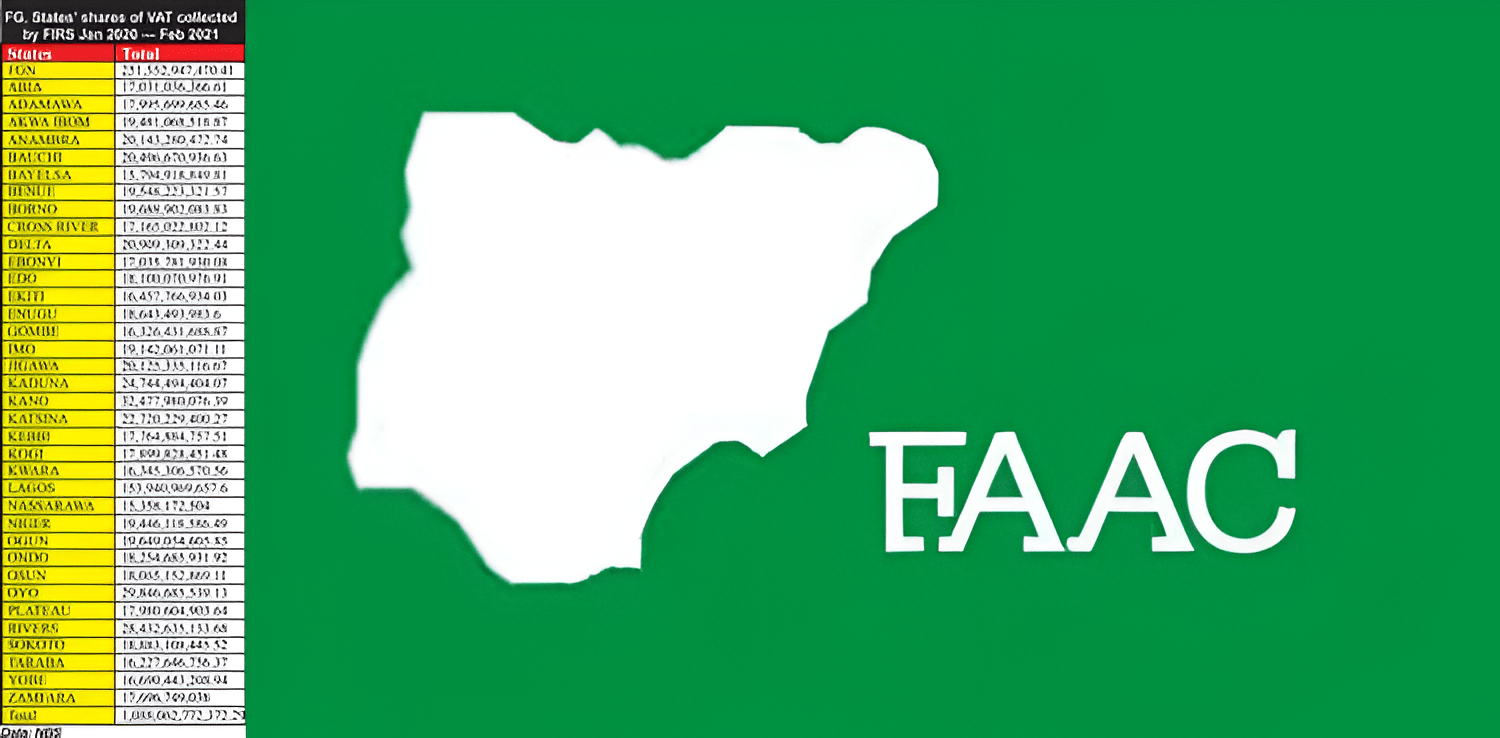

Echotitbits take: The big question is execution—how much of the capital vote survives mid‑year reality? Watch Q1 and Q2 FAAC inflows, new bond/loan issuances, and whether states publish project‑level dashboards to prove capital delivery.

Source: The Punch — December 28, 2025 (https://punchng.com/govs-bank-on-faac-loans-to-fund-2026-budgets/)

The Punch 2025-12-28