According to The Nation, the Central Bank of Nigeria has projected an optimistic economic outlook for 2026, forecasting a 4.49% growth in Gross Domestic Product. The apex bank also anticipates that inflation will ease significantly, aiming for an average of 12.94% by the end of the year.

The projections are based on the expected stabilization of the foreign exchange market and an increase in domestic oil production. The CBN believes that the ‘painful but necessary’ reforms of the past two years are finally yielding a foundation for sustainable non-oil sector expansion.

This optimism is shared by the World Bank, which recently gave a ‘positive verdict on Nigeria’s economic growth trajectory,’ citing three years of unbroken growth. Furthermore, The Guardian reported that AI integration in the financial sector will ‘revolutionize risk pricing and personalized liquidity management,’ further supporting the CBN’s modernization goals.

Echotitbits take: Achieving sub-13% inflation from the highs of 2024–2025 is an ambitious target. Watch for the CBN to maintain high interest rates well into mid-2026 to ensure this disinflationary trend isn’t disrupted by election-cycle spending or supply shocks.

Source: The Guardian — https://guardian.ng/business-services/cbn-projects-4-49-growth-lower-inflation-in-2026-outlook/

The Guardian January 3, 2026

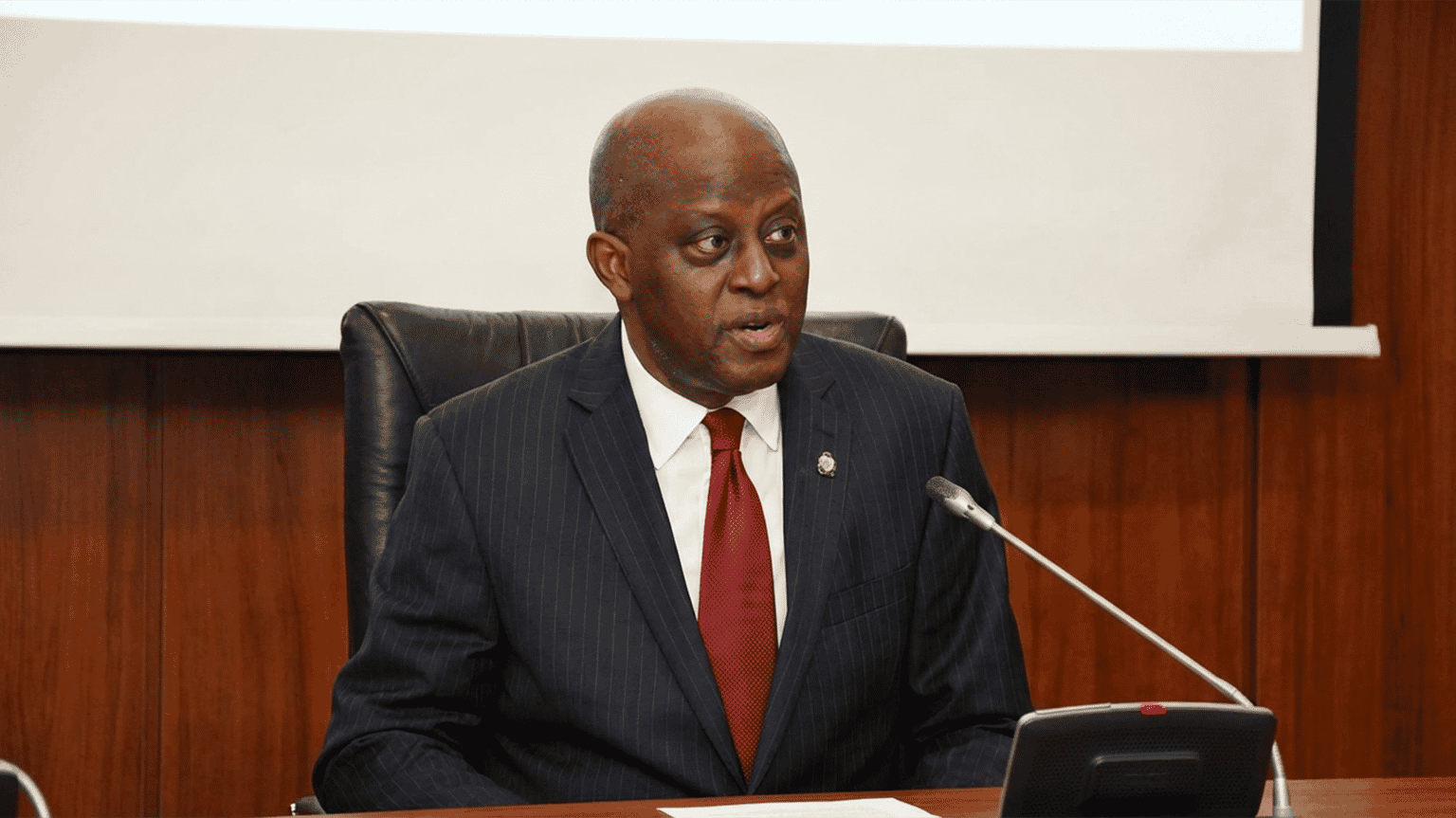

Photo Credit: The Guardian