2026-01-01 07:10:00

Reporting by Vanguard indicates an FCT High Court refused to restrain the Federal Government from proceeding with the January 1 implementation timeline for Nigeria’s new tax laws.

The suit sought an urgent stop order via an ex-parte request, but the court declined, allowing implementation to proceed while substantive issues remain pending.

The decision lands amid public controversy over the reforms, including claims of discrepancies between passed and gazetted versions.

Reuters separately quoted President Tinubu calling the reforms a “once-in-a-generation” reset and stating “No substantial issue has been established” to justify halting implementation.

Daily Post Nigeria also reported the presidency has “dismissed claims of discrepancies” in the new laws.

Echotitbits take:

For businesses, the immediate risk is compliance uncertainty while litigation continues. Watch for official FAQs, enforcement timelines, and any rapid ‘clean-up’ amendments that resolve document-version disputes.

Source: Vanguard — January 1, 2026 (https://www.vanguardngr.com/2025/12/court-declines-to-stop-implementation-of-new-tax-laws-adjourns-case-to-jan-9/)

Vanguard 2026-01-01

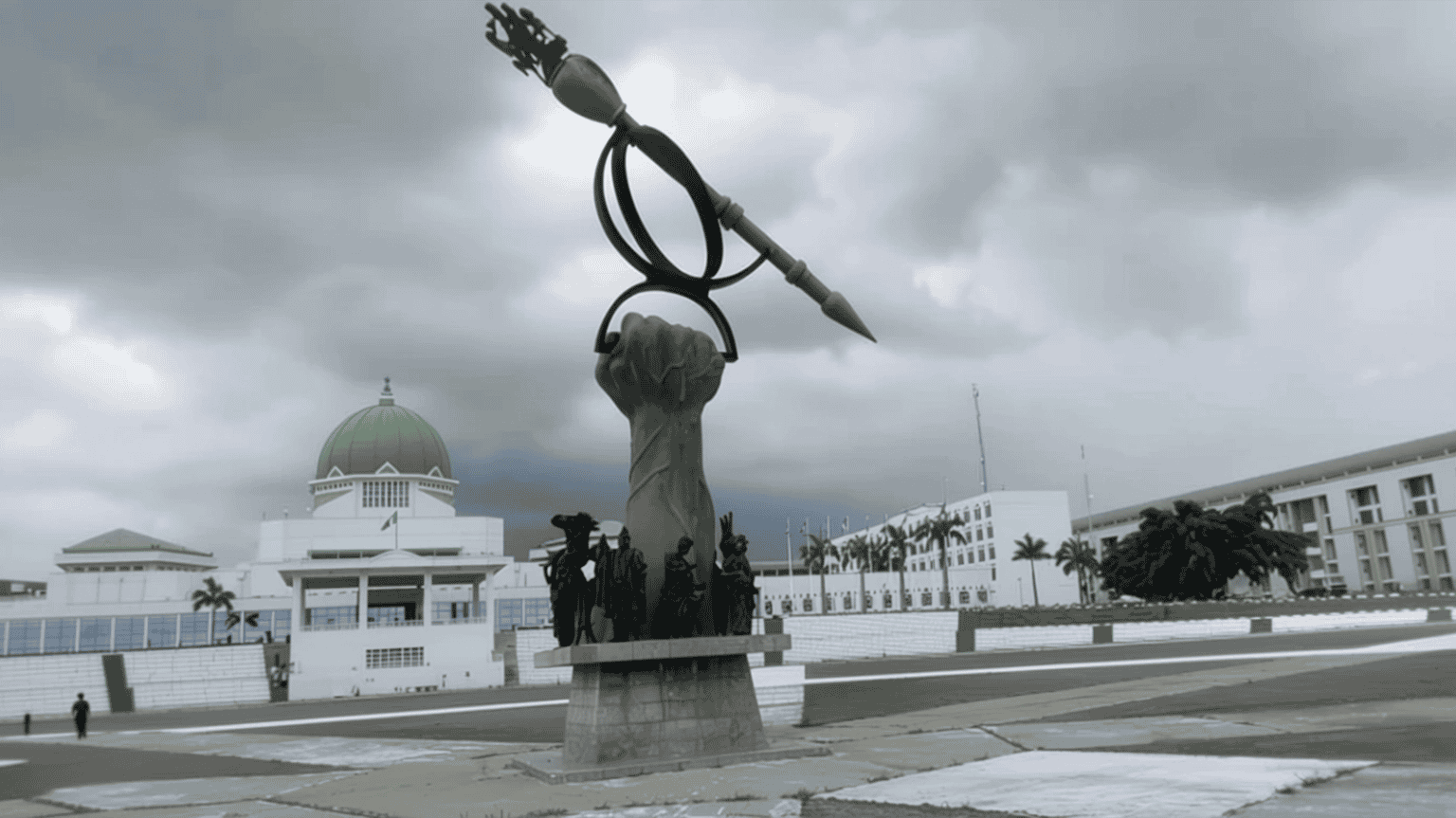

Photo Credit: Vanguard