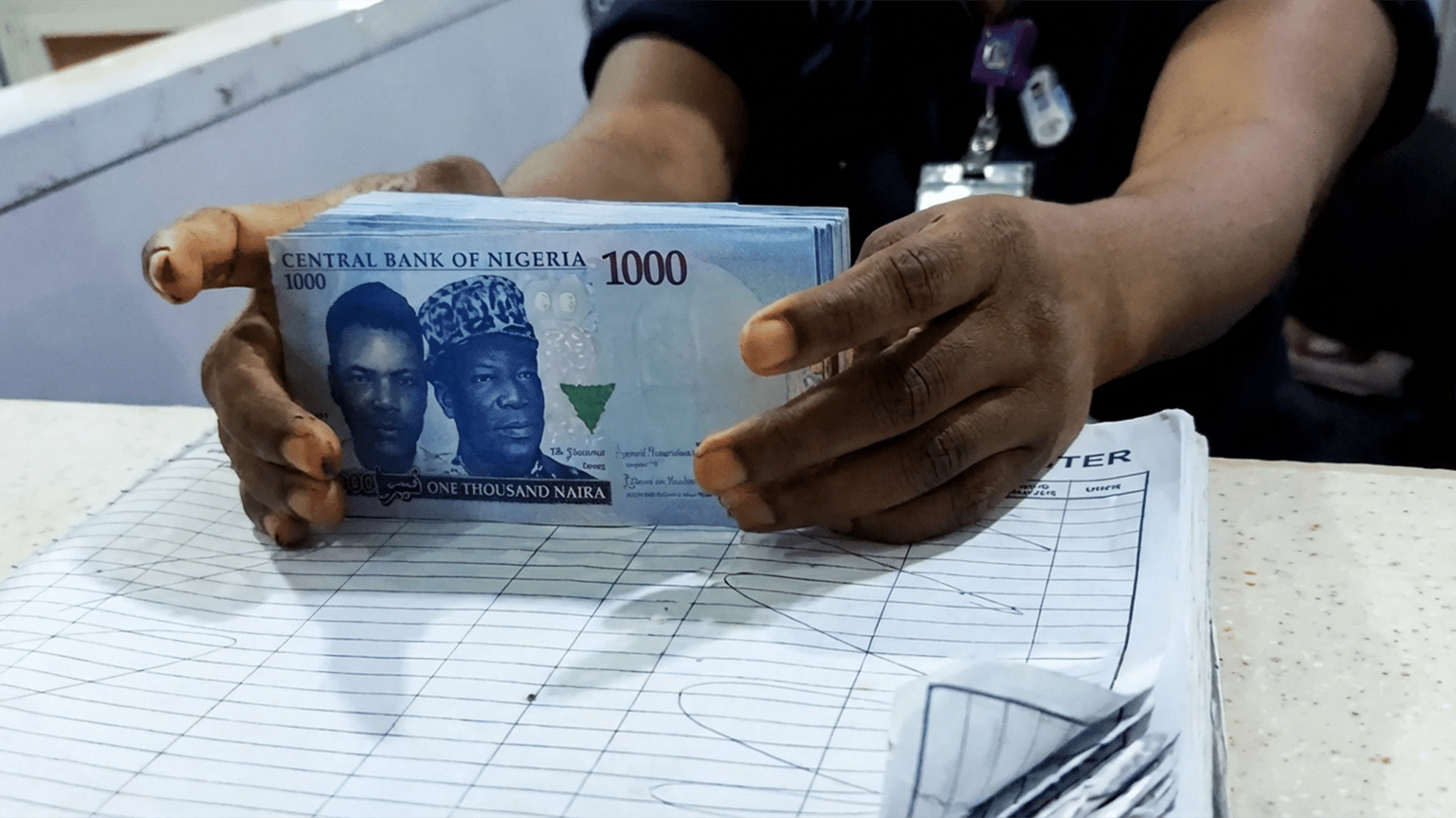

Figures cited by Leadership Newspaper show a significant stabilization in Nigeria’s Foreign Exchange (FX) market, following a high-profile meeting between President Bola Tinubu and the Chairman of Heirs Holdings, Tony Elumelu. Elumelu informed reporters at the State House that the era of acute dollar scarcity is largely over, attributing the progress to recent central bank reforms and improved investor confidence.

During the briefing, Elumelu praised the government’s efforts in harmonizing the FX windows and ensuring a more transparent liquidity flow. He noted that the private sector is beginning to feel the positive impact of these fiscal policies, which has allowed for better planning and increased foreign direct investment into critical sectors like power and manufacturing.

Reports from The Nation and Vanguard corroborate Elumelu’s optimistic outlook. The Nation mentioned that “the Naira has maintained a steady range against the dollar for the third consecutive week,” and Vanguard quoted Elumelu saying: “The FX market is sorted; what we see now is the result of painstaking reforms that have finally gained traction.”

Echotitbits take: While the declaration of the “end” of dollar scarcity is bold, the stability Elumelu references is essential for business planning in 2026. However, the true test remains the sustained availability of FX for small and medium-sized enterprises (SMEs) who often lack the access of larger conglomerates.

Source: The Punch – https://punchng.com/elumelu-meets-tinubu-says-dollar-scarcity-over-fx-market-sorted/, February 14, 2026

Photo credit: The Punch

Tag: Naira Exchange Rate

-

Tony Elumelu Meets President Tinubu, Declares End to Dollar Scarcity

-

Nigeria Faces Deepening Economic Crisis as Currency Gap Widens

Figures cited by BusinessDay show that the Nigerian economy is facing renewed pressure as the gap between the official and parallel market exchange rates has widened to over N90. This development marks the most significant divergence in three years, threatening the government’s efforts to achieve exchange rate convergence and stabilize the local currency.

The widening gap is attributed to a “scramble for FX” by importers and a slowdown in foreign capital inflows. Despite the Central Bank’s recent policy adjustments, liquidity remains tight, forcing many businesses to source dollars at exorbitant rates from the black market. This has directly contributed to the rising cost of imported raw materials and finished goods, further fueling headline inflation.

Economic experts warn that if the divergence continues, it could lead to another round of official devaluation. The manufacturing sector is particularly hit, with many firms reporting narrowed profit margins and reduced production capacity. The government’s 2026 budget projections, which rely on a stable exchange rate, are now under threat of significant revision.

Validating data from ThisDay and The Sun confirm the market volatility. ThisDay reported that “the FX scarcity is stalling major infrastructure projects,” while The Sun quoted a financial analyst stating, “the market is reacting to the delay in the anticipated $3 billion emergency loan from international lenders.”

Echotitbits take: The “Naira-mismatch” is back, and it’s a nightmare for the Central Bank. Watch for a potential hike in interest rates (MPR) in the next MPC meeting as the CBN tries to mop up excess liquidity and attract investors to the fixed-income market.

Source: Legit.ng – https://www.legit.ng/business-economy/economy/1695884-naira-suffers-decline-forex-market-exchange-gap-widens/, February 10, 2026

Photo credit: Legit.ng

-

Naira Maintains Stability Against Dollar Amid Low Speculative Demand

Figures cited by Vanguard show that the Nigerian Naira opened at ₦1,367.10 per dollar in the official window this Friday, maintaining a steady course below the ₦1,400 threshold. Financial analysts attribute this relative calm to the Central Bank of Nigeria’s (CBN) consistent market interventions and a transparent electronic trading framework that has significantly dampened the activities of currency speculators.

The currency’s performance was also tracked by BusinessDay and The Cable, which both reported a narrowing gap between the official and parallel markets. BusinessDay observed that “the absence of aggressive hoarding has stabilized retail demand,” while The Cable quoted a BDC operator in Abuja saying, “The market is no longer as volatile as it was last year; supply is more predictable now.”

Market experts suggest that the current stability is a result of a 15.15% moderating inflation rate and the CBN’s decision to maintain the Monetary Policy Rate at 27.00%. This high-interest-rate environment has continued to attract foreign portfolio investment, providing the necessary liquidity to support the local currency.

Echotitbits take: The Naira’s stability is a win for the CBN’s orthodox monetary policies. However, for this to be sustainable in the long term, Nigeria needs to significantly diversify its export base to move beyond total reliance on oil-driven forex inflows.

Source: Legit.ng – https://www.legit.ng/business-economy/economy/1695016-dollar-stumbles-year-naira-opens-month-a-surprise-surge/, February 6, 2026

Photo credit: Legit.ng

-

Naira Strengthens Against Dollar as Market Liquidity Stabilizes

According to reporting by Vanguard, the Nigerian Naira sustained its positive momentum against the United States dollar during the early trading hours of Thursday, February 5, 2026. The local currency opened at approximately 1,368.56 per dollar at the Nigerian Foreign Exchange Market (NFEM), reflecting a steady appreciation from the 1,388 levels recorded only 24 hours prior. This recovery is largely attributed to the Central Bank of Nigeria’s (CBN) aggressive market-matching strategies and a robust increase in external reserves.

The Electronic Foreign Exchange Matching System (EFEMS) has been cited as a primary driver for narrowing bid-ask spreads, fostering greater transparency within the official window. In the parallel market, the dollar exchanged between 1,450 and 1,465 across major hubs like Lagos and Abuja. Bureau De Change operators noted that while a premium remains, the gap between official and informal rates has contracted to one of its lowest margins in several months due to steady supply from diaspora remittances.

The Punch and ThisDay have corroborated this downward trend in exchange volatility. Business analysts at The Punch remarked that “the Naira’s resilience this week suggests a shift from speculative behavior to demand-driven market fundamentals.” Similarly, ThisDay reported that “investor confidence is returning as the CBN stabilizes the liquidity pool,” with one analyst noting that “we are seeing the most stable foreign exchange window since the unification reforms of 2024.”

Echotitbits take:

The narrowing gap between the official and parallel market rates is a significant victory for the CBN’s monetary policy. If the current liquidity levels are maintained through Q1 2026, we expect a further reduction in imported inflation, which could lead to a potential softening of interest rates by mid-year. Watch for the next Monetary Policy Committee (MPC) meeting to see if these gains trigger a shift from the current 27% MPR.

Source: BusinessDay – https://businessday.ng/news/article/naira-maintains-steady-rise-hits-n1358-28-as-reserves-grow/, February 5, 2026

Photo credit: BusinessDay

-

Naira Maintains Resilience in Official Market as Exchange Rate Stabilizes

Figures cited by Vanguard show that the Nigerian Naira held its ground against the US Dollar on February 4, 2026, opening the session at approximately N1,387.42 in the official window. This continued stability is being attributed to the sustained impact of the Central Bank of Nigeria’s (CBN) Electronic Foreign Exchange Matching System (EFEMS), which has drastically reduced speculative activities and improved market transparency.

Market analysts observe that the naira’s performance is bolstered by healthy external reserves and the clearing of historic FX backlogs. While the parallel market continues to trade at a premium—ranging between N1,460 and N1,475—the spread has narrowed significantly compared to the volatility experienced in late 2025. The absence of “aggressive speculative activity” is seen as a major win for the current monetary policy direction.

This stability is corroborated by reports from Punch and ThisDay. Punch highlights that the convergence of rates is helping corporate planning, stating that “businesses are finally seeing a predictable window for import financing.” Meanwhile, ThisDay reports that the central bank’s recent liquidity injections have successfully met retail demand, with an analyst quoted as saying, “The current exchange rate reflects a genuine market equilibrium rather than artificial suppression.”

Echotitbits take: The Naira’s stability is a breather for an economy that has faced years of currency trauma. The success of the EFEMS suggests that structural reforms in the FX market are finally taking root. For the average Nigerian, this could lead to a gradual reduction in the cost of imported goods, provided the CBN maintains its current level of transparency and supply.

Source: The Punch – https://punchng.com/naira-hits-1418-26-at-official-market/, February 4, 2026

Photo credit: The Punch

-

Nigerian Naira Maintains Resilience as Official Exchange Rate Dips Below 1,400

Figures cited by Vanguard show the Naira holding below the 1,400-per-dollar threshold in the official market. On Thursday morning, the currency opened around 1,395.09/$ in the Nigerian Foreign Exchange Market (NFEM), supported by liquidity improvements and the Central Bank’s Electronic Foreign Exchange Matching System (EFEMS).

While the parallel market remained higher, the narrowing premium suggests speculative pressure may be easing. Analysts attribute the resilience to efforts to clear FX backlogs and to a rise in external reserves, giving the central bank more room to intervene and smooth volatility.

The Punch noted the currency’s benefit from improved price discovery, while ThisDay quoted market analysts pointing to reduced panic buying and improving investor confidence.

Echotitbits take: Staying below the 1,400 psychological level is a notable win for the CBN narrative on stability. The next key signal is the MPC decision: holding rates could protect the FX gains, while easing could support growth but risk renewed pressure if liquidity tightens.

Source: Facebook/TheCable – https://web.facebook.com/thecableng/posts/naira-appreciates-to-n1400-at-official-market-strongest-performance-since-may-20/1213502280966076/?_rdc=1&_rdr# 2026-01-29

Photo Credit: Facebook/TheCable

-

Nigerian Naira Gains Ground in Official Market as Reserves Hit $46 Billion

Reporting by Vanguard indicates that the Nigerian Naira has maintained a strong positive trajectory against the United States Dollar during the mid-week trading session. In the Nigerian Foreign Exchange Market (NFEM), the local currency strengthened significantly, settling at approximately 1,400.66 per dollar. This appreciation is being fueled by increased liquidity and a surge in the country’s external reserves, which have now surpassed the $46 billion mark, providing a substantial buffer for the Central Bank of Nigeria (CBN).

The stability in the official window is starting to reflect in the parallel market, where panic buying has largely subsided. While the “black market” rate remains slightly higher, trading between 1,480 and 1,485, the narrowing gap between the two rates suggests that the CBN’s recent monetary policy adjustments are beginning to take hold. Financial experts predict that if the current liquidity levels are sustained, the Naira could settle into a predictable range of 1,400 to 1,500 for the remainder of the fiscal year.

Market data from MarketForces Africa corroborated the gains, noting that the “Naira touched N1,400 per Dollar in the Nigerian currency market” following a series of aggressive interventions. The Nation also reported on the currency’s resilience, with a financial analyst quoted as saying, “The absence of speculative pressure is a clear signal that the market is beginning to trust the current FX management framework.”

Echotitbits take: The growth in external reserves is a vital sign of economic recovery, likely driven by improved crude oil production and foreign portfolio inflows. Watch for whether this stability translates into a reduction in the prices of imported consumer goods over the next quarter.

Source: BusinessDay – https://businessday.ng/business-economy/article/naira-gains-as-reserves-reach-eight-year-high-of-46bn/ January 28, 2026

Photo Credit: BusinessDay

-

Naira Maintains Stability as CBN Projects Positive 2026 Outlook

Naira Maintains Stability as CBN Projects Positive 2026 Outlook

The naira traded within a narrow band mid-week as CBN interventions and a more optimistic 2026 forecast supported FX market stability.

Further reporting across multiple outlets indicates the development is drawing heightened attention, with stakeholders watching for next steps from relevant authorities and institutions.

Echotitbits take: Stability is the goal, but the true test will be the CBN’s ability to maintain these levels without burning through foreign reserves. Keep an eye on the February inflation data to see if the currency stability translates to lower consumer prices.

Source: The Guardian — https://guardian.ng/business-services/cbn-survey-projects-steady-naira-improved-economic-activities-in-2026/ (2026-01-21)

Photo credit: The Guardian

2026-01-21 15:00:00