Reporting by Vanguard indicates the Presidency has rejected elements of a KPMG critique of Nigeria’s new tax laws, insisting the reforms were designed with specific policy trade-offs in mind.

The report suggests the government is trying to calm uncertainty for businesses and investors, especially around implementation details, compliance costs, and transitional arrangements.

Analysts say pushback alone won’t settle concerns; what matters is clarity—guidelines, timelines, dispute-resolution pathways, and how enforcement will be applied to SMEs and large corporates.

Businesses will be watching for harmonisation to reduce multiple taxation and for improvements in tax administration to curb arbitrary charges.

Echotitbits take: This is a credibility moment. Watch for implementing regulations and whether revenue agencies standardise processes—or whether the old ‘multiple levies’ problem persists.

Source: Vanguard – https://www.vanguardngr.com/2026/01/presidency-rebuts-kpmgs-claims-on-new-tax-laws-defends-reform-choices-2/ 11 January 2026

Vanguard 2026-01-11

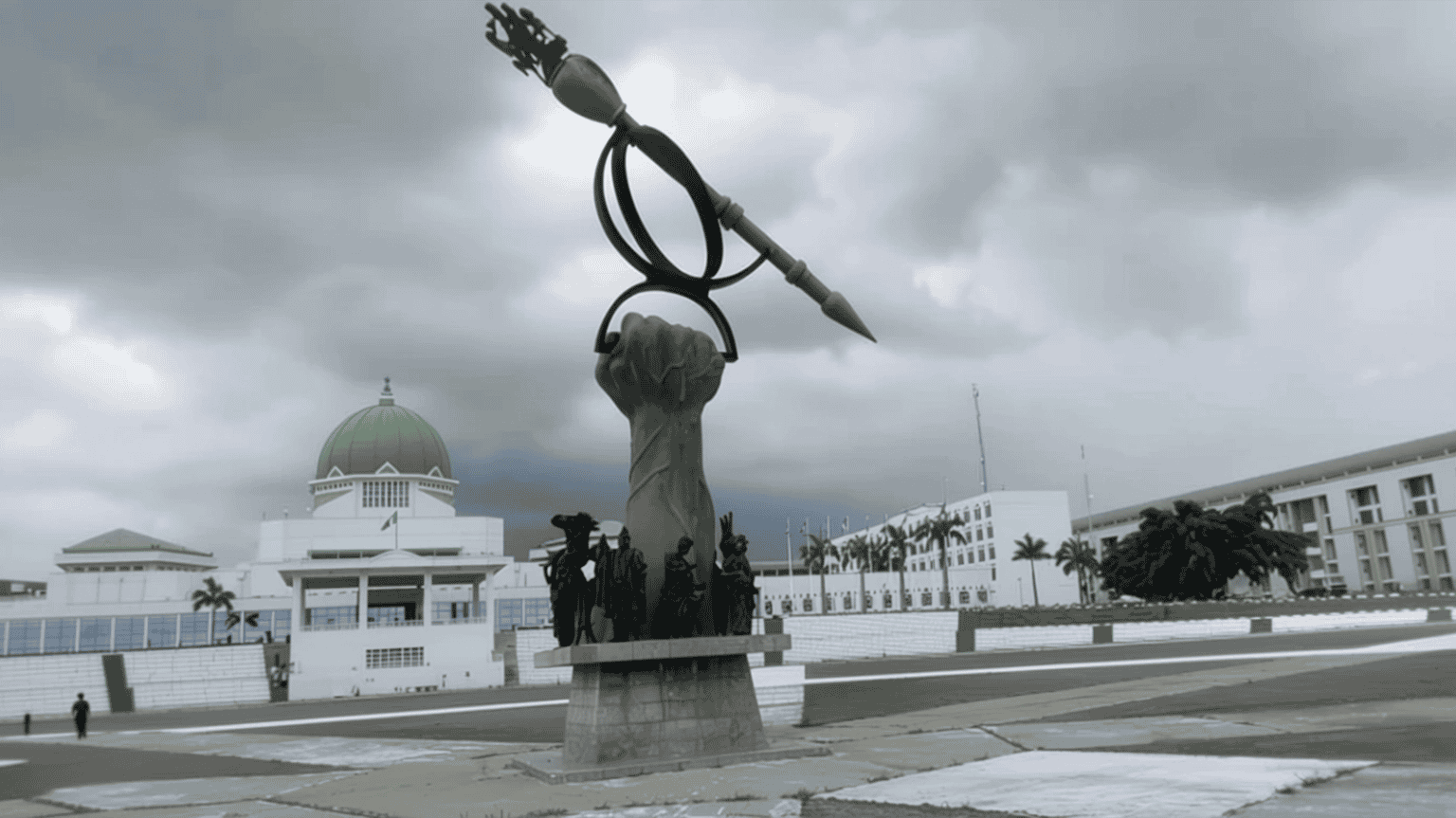

Photo Credit: Vanguard