2025-12-31 09:14:00

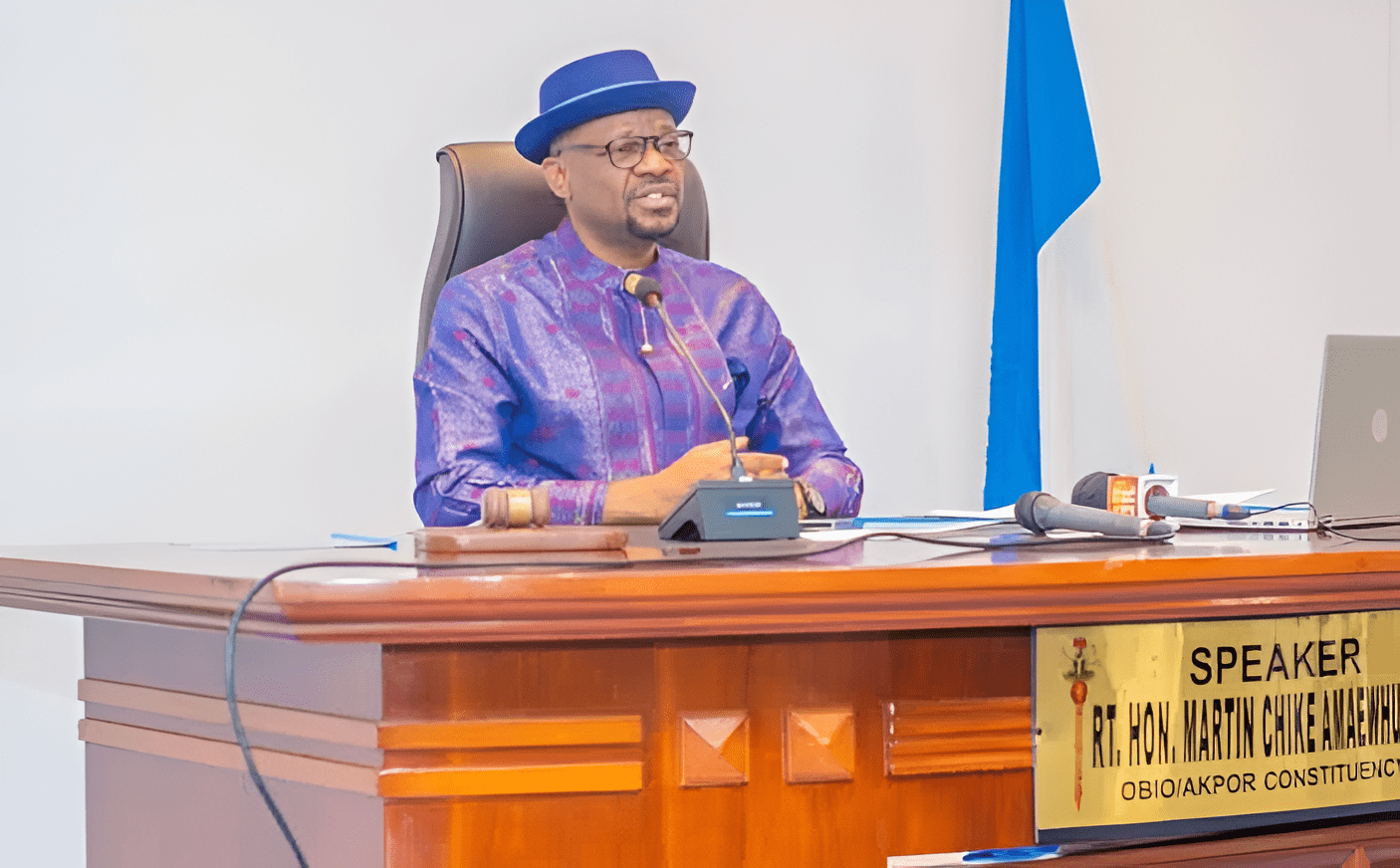

In a report published by PUNCH, members of the Rivers State House of Assembly said they rejected—and moved to return—N100,000 credited to each lawmaker’s account as a Christmas bonus, arguing it did not follow proper authorisation.

The lawmakers framed the transfer as an ‘unapproved’ payment and linked it to the wider political standoff in the state, insisting the executive must adhere strictly to constitutional and budget processes.

The development adds another flashpoint to Rivers’ tense political climate, with analysts watching for how it affects governance, budgeting and the executive‑legislature relationship in early 2026.

Vanguard reported that assembly members “have returned the N100,000 Christmas bonus given to them by the governor,” while Leadership said lawmakers “have rejected the N100,000 Christmas Bonus credited to their personal bank accounts.”

Echotitbits take: Beyond the headline, this is a proxy fight over legitimacy and control of state institutions. Expect more legal manoeuvres and competing public narratives. Watch whether public finance processes (appropriation, releases, oversight) become the next battleground.

Source: The Punch — December 31, 2025 (https://punchng.com/rivers-lawmakers-reject-fubaras-n100000-christmas-bonus/)

The Punch December 31, 2025

Photo Credit: The Punch