According to Cowrywise Financial Blog, the new Nigerian Tax Act has officially come into full effect as of January 1, 2026, introducing a 0% tax rate for individuals earning ₦800,000 or less per year. This reform is part of a broader strategy to provide ‘social cushioning’ for low-income earners while progressively increasing the tax burden on high-net-worth individuals and large corporations. The new brackets peak at 25% for those earning over ₦150 million.

The act also introduces significant relief for small businesses, with the ‘Development Levy’ now only applying to companies with a turnover exceeding ₦100 million. Additionally, the threshold for tax-exempt redundancy pay has been increased from ₦10 million to ₦50 million, providing a larger safety net for workers facing job losses in a fluctuating economy.

Validating reports from Moniepoint and The Punch emphasize the focus on compliance. Moniepoint warned that ‘unregistered businesses will struggle to operate on digital platforms under the new code,’ while The Punch quoted the FIRS Chairman: ‘Our goal is a broader base, not necessarily higher rates for the common man.’

Echotitbits take: This is the most significant overhaul of personal income tax in decades. While the ₦800k exemption is a win for the poor, the real challenge is the ‘informal sector’ capture. Watch for a massive push by the FIRS to link Bank Verification Numbers (BVN) and National Identity Numbers (NIN) to new ‘Tax IDs’ for petty traders this quarter.

Source: TheCable – https://www.thecable.ng/key-concerns-and-benefits-as-the-new-tax-laws-take-effect/ January 5, 2026

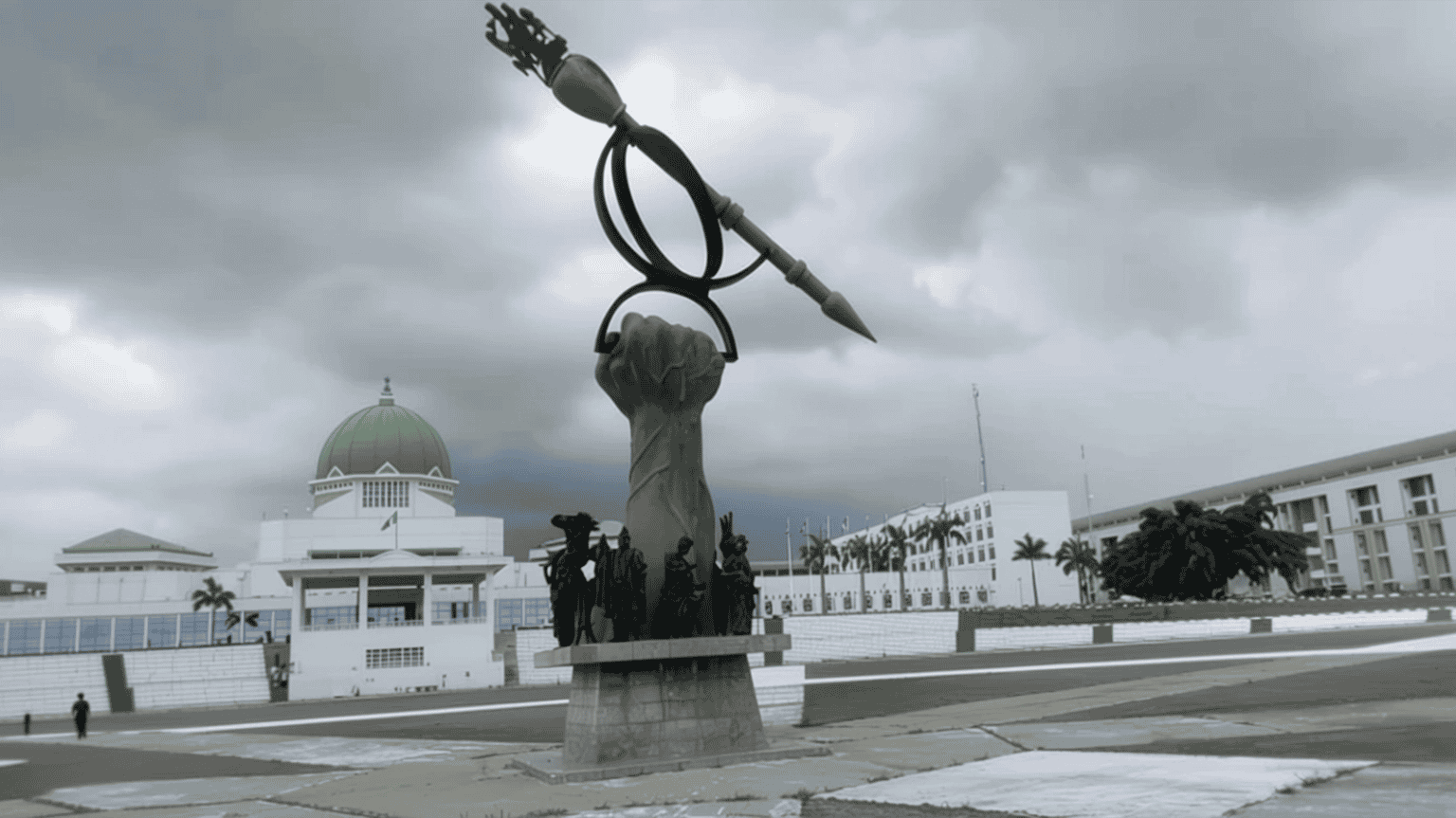

Photo Credit: TheCable