The Ogun State Governor, Prince Dapo Abiodun on Wednesday signed Today into law the Revised 2020 Appropriation Bill, which reduced the state's budget from...

The Central Bank of Nigeria (CBN) Wednesday demanded statutory powers from the Nigerian Senate to enable freeze bank accounts that are linked to criminal...

Government of the United States of America (USA) has finally charged Ramon Abbas Olorunwa Igbalode popularly known as Ray Hushpuppi to court in Los...

The Ogun State government has reacted to some media reports that erroneously claimed the state generated merely Seventy billion, nine hundred and twenty two...

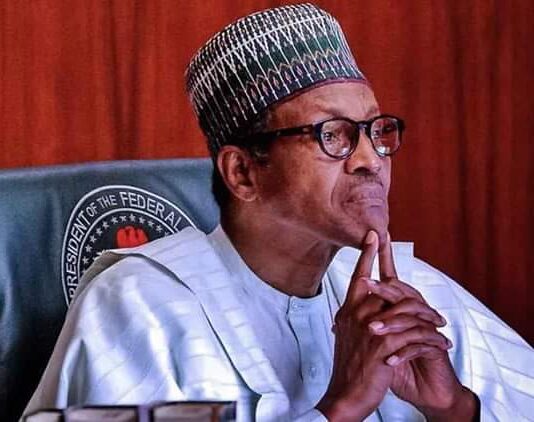

The Presidency says it will require additional fresh external loan of $5.513 billion to finance 2020 budget deficit.

In a letter addressed to the House...

By Tobiloba Kolawole

No less than 5,000 African entrepreneurs, private and public sector leaders and the broader entrepreneurship ecosystem converged on Lagos on Thursday, October 25,...